Backtested results are adjusted to reflect the reinvestment of dividends and other income and, except where otherwise indicated, are presented gross-of fees and do not include the effect of backtested transaction costs, management fees, performance fees or expenses, if applicable. Actual performance may differ significantly from backtested performance. Further, backtesting allows the security selection methodology to be adjusted until past returns are maximized. Since trades have not actually been executed, results may have under- or over-compensated for the impact, if any, of certain market factors, such as lack of liquidity, and may not reflect the impact that certain economic or market factors may have had on the decision-making process. Specifically, backtested results do not reflect actual trading or the effect of material economic and market factors on the decision-making process. Backtested performance is developed with the benefit of hindsight and has inherent limitations. This information is provided for illustrative purposes only. No representations and warranties are made as to the reasonableness of the assumptions. Certain assumptions have been made for modeling purposes and are unlikely to be realized. Changes in these assumptions may have a material impact on the backtested returns presented. General assumptions include: XYZ firm would have been able to purchase the securities recommended by the model and the markets were sufficiently liquid to permit all trading. Backtested results are calculated by the retroactive application of a model constructed on the basis of historical data and based on assumptions integral to the model which may or may not be testable and are subject to losses. The results reflect performance of a strategy not historically offered to investors and does not represent returns that any investor actually attained.

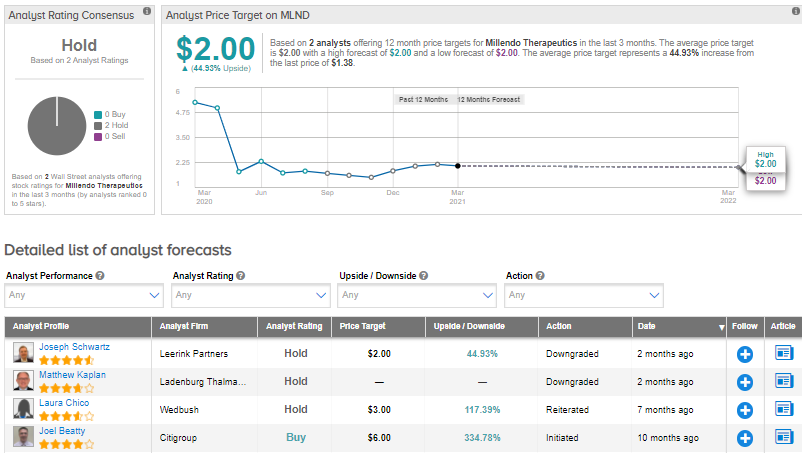

Backtested performance is not an indicator of future actual results. Johnson & Johnson Signs Single-Shot COVID-19 Vaccine Deal With AVATĬognizant To Snap Up ESG Mobility, Boost Digital Automationĭisclaimer: The TipRanks Smart Score performance is based on backtested results. Magnachip To Be Acquired By Wise Road Capital For $1.4B Shares Pop 27% The average analyst price target of $2 implies 45% upside potential to current levels. The rest of the Street is sidelined on the stock with a Hold consensus rating, based on 2 Holds. Recently, Ladenburg Thalmann analyst Matthew Kaplan downgraded the stock to Hold from Buy. We believe we have found a partner that offers not only the greatest value for our existing shareholders but also promising targeted oncology product candidates for patients living with cancer.” Millendo CEO Louis Arcudi said, “Millendo Therapeutics’ strategic review was a thorough and thoughtful process. ( See Millendo stock analysis on TipRanks) When the transaction is finalized, existing Millendo shareholders are anticipated to own 18.5% of the combined entity, while the remaining 81.5% will be owned by pre-merger Tempest stockholders. The transaction, which awaits shareholders’ approval for both companies, the completion of the PIPE financing, and certain regulatory approvals, is likely to close in the first half of this year. Furthermore, the stock will trade on the Nasdaq Capital Market under the ticker symbol TPST.Īdditionally, the cash expected from both companies, the net proceeds of the merger, and financing are anticipated to fund the further development of Tempest’s three oncology programs and the company’s operations into early 2023, the company said. and will be headquartered in South San Francisco.

Upon closure of the deal, Millendo ( MLND) will be renamed Tempest Therapeutics, Inc. To support the merger, Tempest has secured commitments from a premier group of healthcare investors for a $30 million PIPE financing, which is likely to close along with the completion of the merger. The combined entity is likely to focus on developing Tempest’s oncology pipeline of small molecule therapeutics, which could potentially address a wide range of tumors. Shares of the biopharmaceutical company dropped more than 5% in the pre-market session after closing 36.7% lower on March 29. Millendo Therapeutics has agreed to merge with South San Francisco-based Tempest Therapeutics, a privately-held clinical-stage oncology company, in an all-stock deal.

0 kommentar(er)

0 kommentar(er)